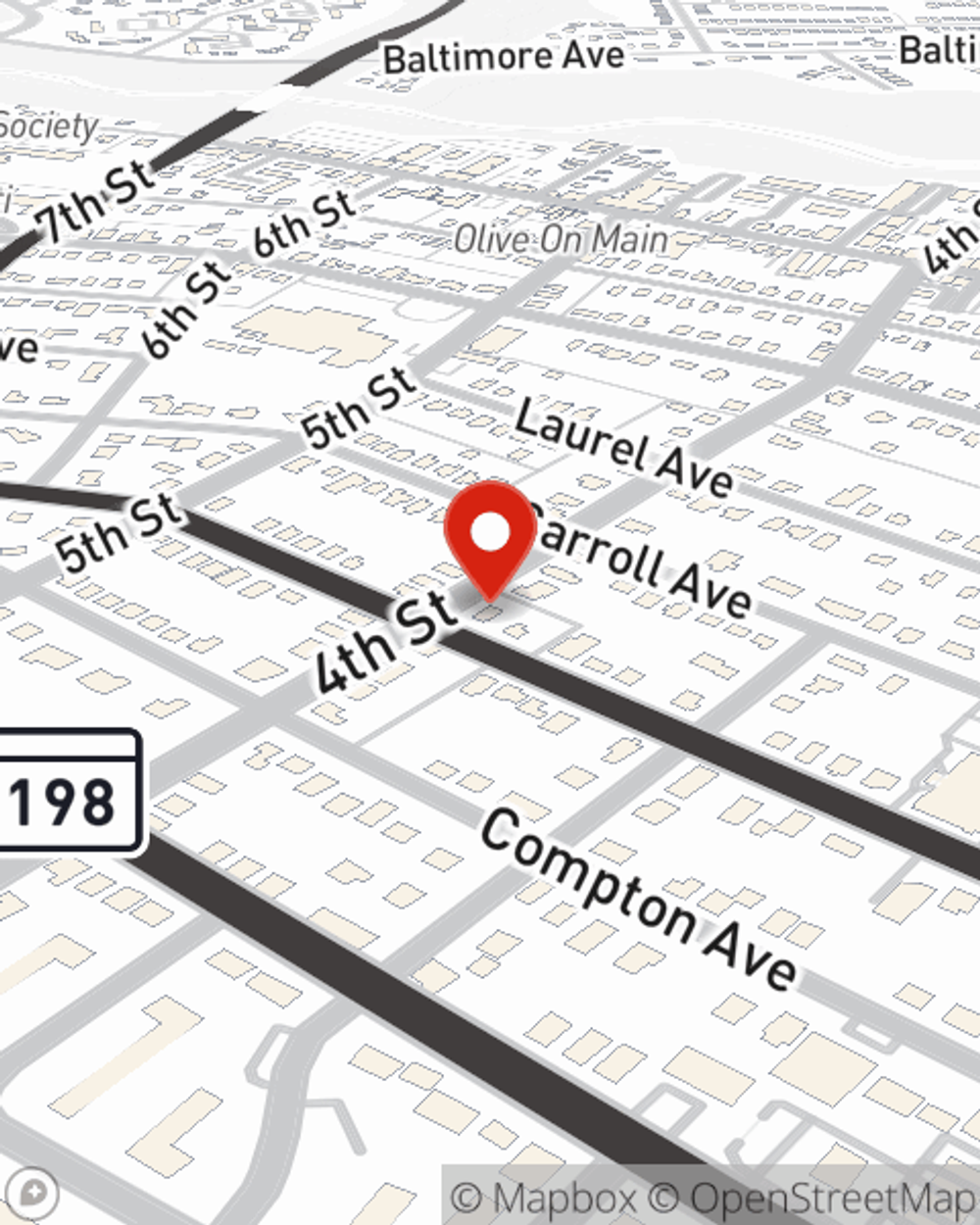

Renters Insurance in and around Laurel

Looking for renters insurance in Laurel?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Trying to sift through deductibles and providers on top of your pickleball league, family events and work, takes time. But your belongings in your rented house may need the impressive coverage that State Farm provides. So when the unexpected happens, your home gadgets, appliances and swing sets have protection.

Looking for renters insurance in Laurel?

Coverage for what's yours, in your rented home

Why Renters In Laurel Choose State Farm

You may be skeptical that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. What it would cost to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

If you're looking for a dependable provider that can help you understand your options, call or email State Farm agent Jennifer Smigal today.

Have More Questions About Renters Insurance?

Call Jennifer at (301) 384-2323 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Jennifer Smigal

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.