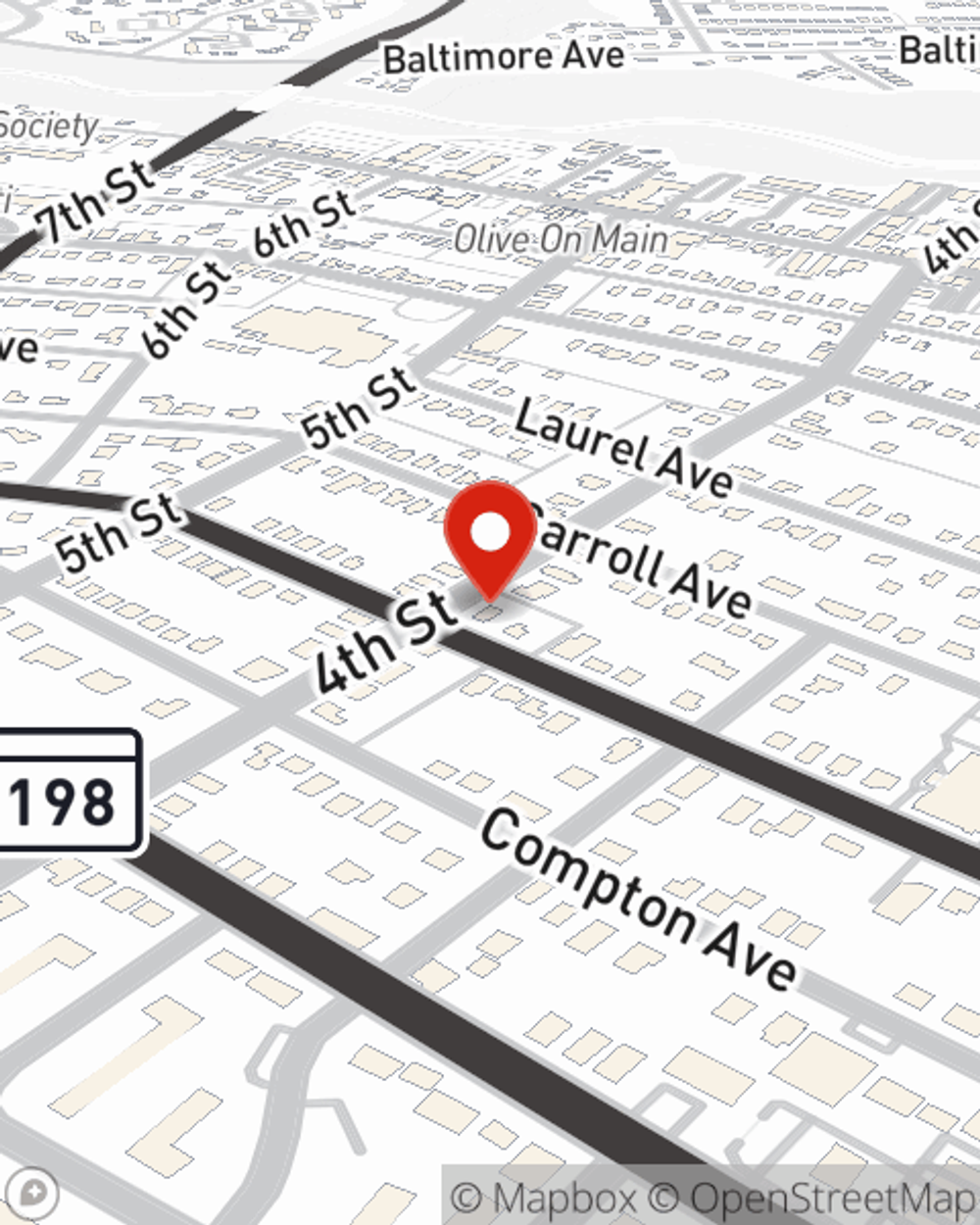

Business Insurance in and around Laurel

Calling all small business owners of Laurel!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jennifer Smigal help you learn about quality business insurance.

Calling all small business owners of Laurel!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

If you're looking for a business policy that can help cover extra expense, computers, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Call or email the excellent team at agent Jennifer Smigal's office to discover the options that may be right for you and your small business.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Jennifer Smigal

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.